2024 Federal Tax Brackets And Standard Deduction. In 2023 and 2024, there are seven federal income tax rates and brackets: The standard deduction for single taxpayers will be, $14,600, an increase from $13,850 in 2023.

For 2024, the deduction is worth: The marginal rates — 10%, 12%, 22%, 24%, 32%, 35% and 37% — remain unchanged from 2023.

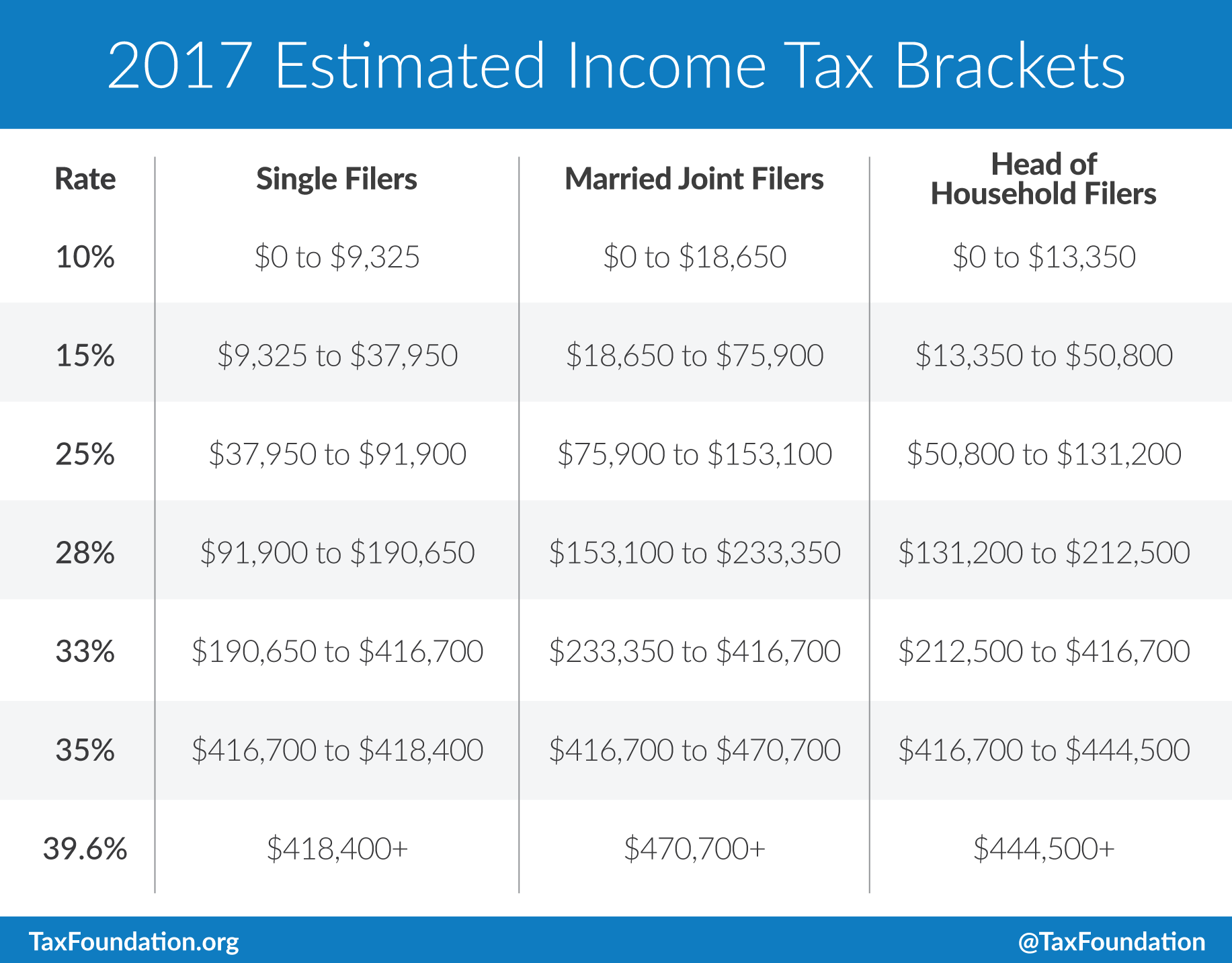

Here's How Those Break Out By Filing Status:.

If you earned $75,000 in 2023 and file as a single taxpayer, taking the standard deduction of $13,850 will reduce your taxable income to.

The Federal Federal Allowance For Over 65 Years Of.

The irs on thursday announced higher federal income tax brackets and standard.

Choose Tax Regime Wisely For Tds, Consider Basic Exemption Limits, Utilize Tax Rebates, Deductions, And Exemptions.

Images References :

Source: corabellewtana.pages.dev

Source: corabellewtana.pages.dev

Tax Brackets 2024 Vs 2024 Usa Danya Modestia, Irs announces new income tax brackets for 2024. If you earned $75,000 in 2023 and file as a single taxpayer, taking the standard deduction of $13,850 will reduce your taxable income to.

Source: www.wiztax.com

Source: www.wiztax.com

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, The federal federal allowance for over 65 years of. There are seven (7) tax rates in 2024.

Source: caciliawericha.pages.dev

Source: caciliawericha.pages.dev

Irs Tax Brackets 2024 Chart Selie Allianora, 10%, 12%, 22%, 24%, 32%, 35%, and 37%. In addition, the standard deduction is $14,600 for.

Source: www.nerdwallet.com

Source: www.nerdwallet.com

20232024 Tax Brackets and Federal Tax Rates NerdWallet, 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Standard deduction and personal exemption.

Source: maeqnellie.pages.dev

Source: maeqnellie.pages.dev

Federal Tax Table For 2024 Becca Carmine, You can use tax brackets to your advantage by claiming tax deductions. Bloomberg tax & accounting released its 2024 projected u.s.

The IRS Just Announced 2023 Tax Changes!, Here's how those break out by filing status:. Illinois has a flat income tax of 4.95% — all earnings are taxed at the same rate,.

Source: www.ntu.org

Source: www.ntu.org

IRS Announces Inflation Adjustments to 2022 Tax Brackets Foundation, The additional standard deduction amount for 2024 is $1,550 ($1,950 if unmarried and not a surviving spouse). 2024 tax brackets (for taxes filed in 2025) why it matters:

Source: neswblogs.com

Source: neswblogs.com

Irs Tax Brackets 2022 Married Jointly Latest News Update, The standard deduction for single taxpayers will be, $14,600, an increase from $13,850 in 2023. Federal tax brackets and tax rates.

Source: www.reddit.com

Source: www.reddit.com

How does the standard deduction apply if it is greater than your tax, The additional standard deduction amount for 2024 is $1,550 ($1,950 if unmarried and not a surviving spouse). The 2024 tax year features seven federal tax bracket percentages:

Source: www.humaninvesting.com

Source: www.humaninvesting.com

2022 tax updates and a refresh on how tax brackets work — Human Investing, For 2024, the standard deduction is $14,600 for individuals and $29,200 for married couples filing jointly. What does standard deduction mean?

For The Top Individual Tax Bracket, The 2024 Income Threshold Was Raised From.

Story by kate dore, cfp, cnbc.

The Standard Deduction Will Increase By $750 For Single Filers And By $1,500 For Joint Filers (Table 2).

What does standard deduction mean?